we specialize in providing everything your token needs to accelerate its liquidity.

OUR SERVICES SUPPORT ALL EXCHANGES WITH API ORDERS CONNECTION

THE QUANT SOLUTION

Market Analysis

We start every project with a thorough market analysis and cross-check it with our previous records and valuable expert advice. Small-scale testing is also conducted before the strategy is finally deployed to ensure it operates smoothly without running into a problem.

Round-the-clock service

We have our team of experts working 24/7 to provide quick follow-ups. We deliver prompt reports and strategies to improve trading by keeping a track of the macro tendencies and trading volumes

Automated market-making

The execution of market making at Quant is all automated and it has changed the landscape of trading. Automation transforms the system into a fairer program with stable prices and reduced chances of slippage

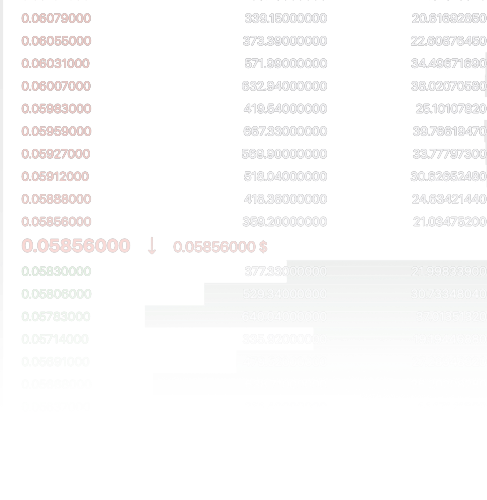

Tighter bid-ask spread

This allows the market to become stable which helps to mitigate the unexpected price fluctuations

Market depth

By Injecting sufficient volume and liquidity in the hedging derivatives, Quant allows the market participants to trade their token without significantly affecting its price

Security

Quant is built with risk-free features and provides complete transparency to the trades

Everything but no fee

We have no overhead expenses for the offer/sell price or any other additional fee.

Exchange networks

We set you off for effective and faster trades on all major exchanges including CEX and DEX

ABOUT US

Why do you need the Quant influence?

Quant maintains a two-way market by constantly quoting (bidding and selling)

To get the best price for your asset

Crypto markets are generally far more volatile than other markets. Without healthy crypto markets, liquidity drops and generates high volatility.

It can result in KPIs around the order book spread and depth, which are the key factors to avoiding chances of slippage.

An orderly entry and exit points for the traders help attract a greater number of investors to safely get in

HOW IT WORKS

OUTSOURCE MM TEAMGET AHEAD OF THE COMPETITION

As it's true for any other crypto project, it's complicated and demands a wide range of subject matter skills. This leads to a skill gap among its developers getting wider which could result in financial and many times organizational risks. This is where our outsourcing service comes into play by providing

Liquidity

outsource market-making allows you to quickly upscale your project and provides greater liquidity in no time

Integration of bots and simulation

of active trades serves as an excellent tool to determine a fair trading value and competitive bid-sell prices

Reporting

individualized reports and thorough analysis are drawn to reflect a plan

Designing a strategy

in accordance with the customer's needs a strategy is devised which fits the plan the most

MM & LIQUIDITY

We Offer Expert Market Making Services

We are a team of young, experienced experts who are passionate about their work. We cooperate with new projects and our mission is to help them start their journey in crypto world

Experience in years

5+

Happy projects

46+

Availability

24/7

Tokenomics

Quant tokenomics

Tokenomics is the design of a cryptocurrency's economic system, including token supply, distribution, utility, economics, and governance. It's important to create a sustainable ecosystem that benefits all stakeholders. If you're launching a cryptocurrency, consider working with a tokenomics consultant who can provide expert guidance and advice. Our tokenomics service can help you design and implement a successful economic model for your project.

Roadmap

Quant roadmap

We know how important it is to design your planning steps with a roadmap, but it is only as good as how you implement it. But don't worry, as Quant knows the drill. The Quant roadmap has been centered around various phases that will be delivered along with multiple time frames. All the phases will be sequentially conveyed while being parallel with thorough research, individualized need, and valuable expert advice.

Need liquidity for your cryptocurrency? Let's do it the Quant way! We are a global crypto liquidity generator and algorithm market maker, which provides competitive quotes on multiple exchanges. While most crypto market makers are offering unreasonable promises, we strive to serve you something Scalable, Sustainable, and Real

Market Making

Liquidity Providers

Exchange Listings

Order Book

Faq

Blog

Contact

Copyright © 2023 Quant MM - Crypto Market Maker & Liquidity Provider, All Rights Reserved.